Employee provident fund organization (EPFO) is a statutory government administered by the ministry of employment&labor.

EPFO is responsible for regulating and managing the provident fund in our country, India.

A UAN (Universal Account Number) is a unique ID to be used to access all the required information related to EPF (Employee Provident Fund).

Impressively the PF money can be easily utilized to buy a new home and for the repayment of the housing loan.

Subject to some conditions, an employee can easily utilize the provident fund amount for housing construction and land purchase.

The login for the EPFO website can be done using the UAN login. Login to the UAN website can also be used to access the UAN passbook, which can be viewed online.

As the UAN website is mandatory to access the employee data, the employee can use the EPFO member login to access the UAN passbook

Table of Contents

What is UAN?

Universal Account Number or UAN is a unique number assigned to the salaried employees who all are covered under the EPF program.

The UAN login also provides access to the EPFO passbook, balance check, and PF contribution details of the EPF account.

With the help of its unique number, UAN is transferable if any employee switches to a new job. It is also required to link the UAN with your Aadhar card number. If anyone fails to do this, the person will not be able to contribute to the PF account.

How to use the EPF money to purchase a new home?

The EPF is a retirement corpus where the salaried employee and the employer contribute up to 12% of their basic employee salary.

The main objective of the EPF money is to offer a supportive amount at the time of the employee’s retirement, and there is a provision to withdraw the money for getting home or for any ongoing construction.

The money can also be used for the repayment of the house loan. But it is not as if you can withdraw the entire money from the provident fund account for the housing purpose.

There are also various conditions attached to the facilities. The conditions of the same are as follows.

- Suppose an employee wishes to go for the provident fund to get a plot of land parcel. In that case, the permissible provident fund limit will be 24 months of the basic salary of the employee with DA or the cost of the plot, whichever is lower.

- Also, if the employee wishes to withdraw the accumulated provident fund amount to buy a ready–to–move–in home, the provident fund withdrawal will be restricted to 36 months of the basic salary of the employee concerned, and the DA or the cost of the property, whichever is lower in the amount.

Repayment of the housing loan using PF money

Along with the above–mentioned norms, a salaried employee with a provident fund account is eligible to withdraw the PF amount for home loan repayment.

However, to avail of the benefit, the employee must be a PF contributor and salaried employee for a minimum of 10 years.

Also, if you wish to repay the home loan using provident fund withdrawal, the withdrawal will be limited to 36 months of the person’s basic salary and the dearness allowance (DA).

The home loan must have been taken from a registered banking institution, registered lenders and non-banking finance company to get money.

Also, if the loan is taken privately from an unregistered entity, the facility is now applicable to the concerned person.

Also read: Hamraaz Web Personal Login

House construction using provident fund money

Along with purchasing the plot or a home buying, the employee provident fund money can also be used for the house construction.

Also, to get the facility, the employee must be a member of the registered housing society or a registered society with a minimum of 10 members.

In such a case, the provident fund withdrawal is lower than 90% of the PF amount and the construction cost of the property.

The construction of the house should start within 6 months from the date of PF money withdrawal. The construction should be completed within 12 months from the last installmentwithdrawal.

It should also be noted that the withdrawal facility for housing-related activities should be allowed only one in life. Also, the PF withdrawal facility is available for housing-related activities.

It is also prudent not to take out the money intended for retirement benefits.

Also, a salaried employee who makes the PF contribution should have their own UAN number. The unique number also comes in handy in case of a job change, the provident fund money withdrawal, etc.

UAN login – how do I know my UAN number?

Before the UAN facility, the EPFO also used to work manually. However, with the introduction of the UAN login, the computerized system also enables a seamless UAN login.

You can also ask the employer to offer the UAN number. It is generally written on the monthly salary slip.

If you face any challenges accessing the UAN number, you can also know UAN online.

To check the UAN number, follow the below steps –

- First login to the official website of the EPFO.

- Now on the right-hand bar, you need to click on the ‘know your UAN’ tab.

- Now when you click on the ‘know your UAN’ tab, the system will be redirected.

- Enter the mobile number and the CAPTCHA, and then click on the ‘request for OPT’ button.

- Now you will get an OTP on the registered mobile number.

- Enter the OTP and click on the ‘validate OTP’ button.

- After that, the system will verify the OTP, and the employee will be redirected to the know your UAN screen.

- Here, you will be asked to fill in the details like name, date of birth, Aadhar card, PAN card, member ID, and the CAPTCHA code.

- Now click on the ‘show my UAN.’ The UAN will also be displayed on the screen.

UAN login is essential to access the UAN passbook and the member portal. You can use the UAN for login in the EPFO UAN login.

Once you know the UAN number, you can easily use it to login to the EPFO website.

How can you do a UAN login on the UAN portal?

You need to follow the below steps to login UAN portal.

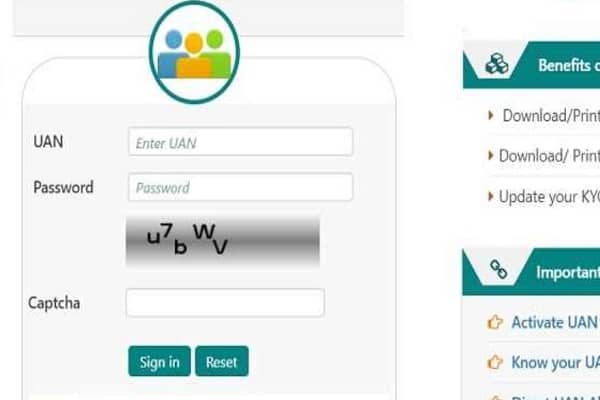

- First login to the official portal of the EPFO.

- Now go to the UAN login on the right side of the home page and key your UAN number with the password.

- After entering the UAN and password, you will be redirected to the dashboard.

- The dashboard will show you details like UAN, name, DOB, gender, Aadhar number, PAN number, bank account number, registered mobile number, and the user’s email ID.

- Under the UAN dashboard, the employee can perform multiple activities like view passbook, change password, manage the account, download the passbook in PDF format, and much more.

- Now when you click on the view button on the front, you will have options like passbook, UAN card, service history, and profile. You can also apply for the UAN card and check the passbook to view your current balance. Service history can also be checked from here.

- Now when you click on the manage button, you will havean option like E-nomination for assigning the nominee, KYC, contact details, and basic details.

- Now you can manage the provident fund account with the help of the account button and can also change the account’s password.

- Under the online service option, you can also perform the following actions

- Download annexure K

- Track claim status

- Request for one member – one PF account